Advice is Personal

Learn how to choose a financial advisor in Charleston with 10 expert tips for finding the right professional for your goals.

5

Minutes

Reggie Fairchild

"Do I need a financial planner right now? Is my advisor the right fit? Should I be doing more with what I’ve built?"

If that’s you, you’re not alone.

Charleston has no shortage of people calling themselves “financial advisors.” Some are product salespeople, some focus only on investments, and some provide truly holistic planning. If you’re navigating real complexity with taxes, retirement, business transitions, or estate planning, choosing the right advisor matters. You want someone who is going to partner with you.

At Flip Flops and Pearls, we work with a select group of high-income professionals, business owners, and retirees. These are people who are too busy for spreadsheets and guesswork but who care deeply about making intentional decisions.

This blog walks you through how to choose a financial advisor in Charleston with confidence. We'll cover how to evaluate fee-only fiduciaries, questions to ask about retirement planning and investment philosophy, and what makes a planner truly worth their fee.

1. Start With Fit: Do They Understand People Like You?

Your financial life isn't generic. You want someone focused on your specific goals and situation. If you’re dealing with equity compensation, real estate holdings, business succession, or multigenerational planning, you need someone fluent in your world.

A good advisor should understand the complexity of your tax picture, your time constraints, and the emotional side of money. You should work with someone you like and respect, but fit isn’t just about personality—it’s about competence in the context of your life.

2. Fiduciary and Fee-Only: Why It Really Matters

We think using a Fee-Only Fiduciary is essential because it aligns your advisor's interests as much as possible with your interests.

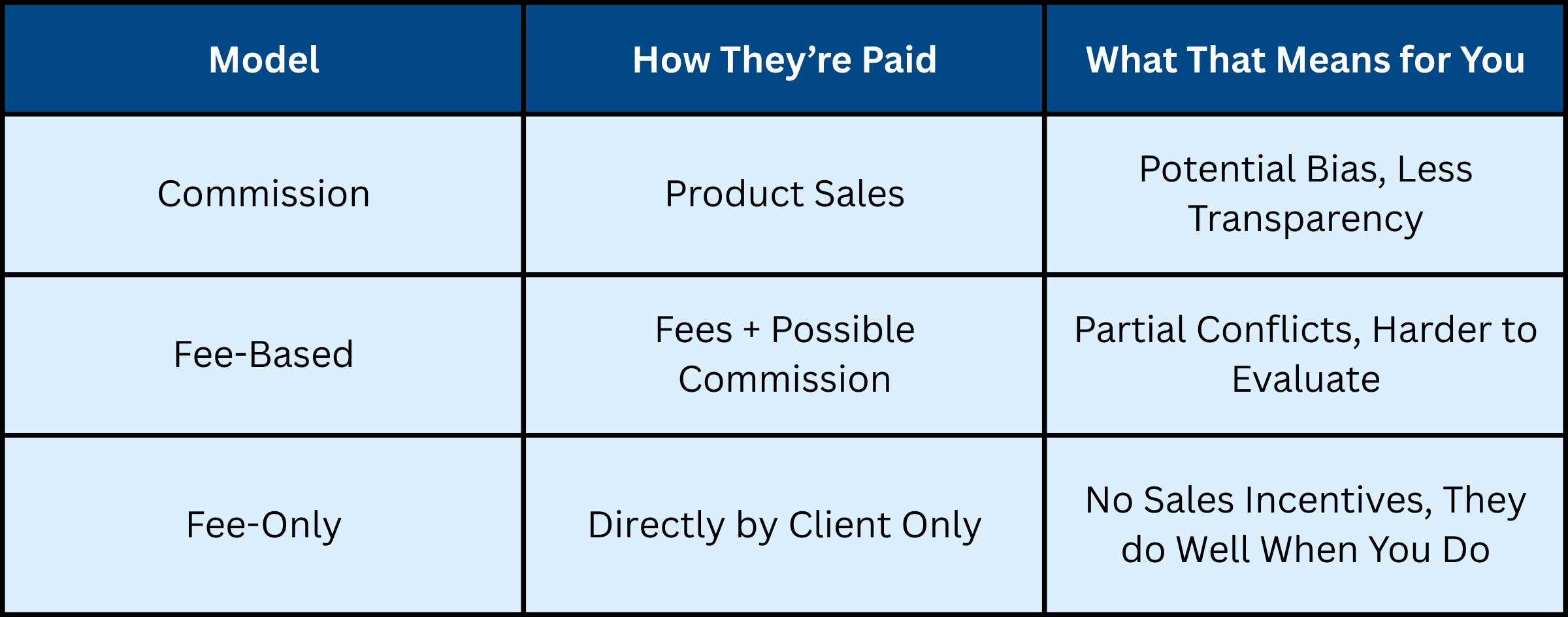

There are three main types of advisor compensation: commission-based, fee-based, and fee-only. Understanding these models is important because they impact how your advisor gets paid and what they get paid for.

Understanding advisor compensation models helps you evaluate where their incentives lie, and how advisors are aligned with your interests.

It’s one thing to claim fiduciary duty. It’s another to build your business model around it. Fee-only advisors, unlike fee-based or commission advisors, are only paid by you—which generally eliminates conflicts of interest (although there are a few unique cases; when one arises, we'll always highlight it for you).

Here’s why we believe fee-only financial planning is a non-negotiable.

3. Will They Show Up for You, Year After Year?

The best planners become long-term partners. They know your values and your people. Not just quarterly check-ins—but real availability when life throws a curveball.

4. Independent, Not Influenced

The best Independent Registered Investment Advisors (RIAs) aren’t tied to quotas, sales goals, or corporate product shelves. That independence empowers them to build custom strategies tailored to your life—not someone else’s business goals.

5. Planning First, Then Portfolios

Investments are just the engine—not the destination. A planner should help you define what you're solving for first: Do you want to work less? Fund a child’s education? Buy a vacation home? Retire early or pivot careers?

With those priorities clear, a smart investment strategy can follow. And yes, model portfolios can help manage risk and costs—but only when they serve your plan, not the other way around.

6. Who Will You Actually Work With?

Some firms hand you off after the pitch. Ask who your primary advisor will be, how involved they’ll be, and what continuity looks like. Strong planning relationships are built on consistency, not call centers.

7. Clear Process, Not a Sales Pitch

Choosing a financial advisor shouldn’t feel like a timeshare presentation. Look for a structured, transparent process that gives you time to assess fit before you’re expected to commit. That clarity alone can tell you a lot.

8. Do They Cap Client Load?

An advisor’s capacity directly affects the client's experience. If they’re juggling 300 households, how much time do they really have for you? Ask about their client count, service model, and what "proactive" means in practice.

9. Charleston Roots, National Perspective

Your advisor should know the quirks of Charleston’s financial landscape—from real estate taxes on Sullivan’s Island to working with newcomers. Here’s how we help people relocating to Charleston think through their finances.

That said, good advice isn’t limited by geography. The best advisors bring national experience to local insights.

10. Do They Cover Retirement and College Planning?

The best advisors integrate your full financial picture—not just your investments. That includes tax planning, insurance reviews, estate strategy, and yes, both college and retirement planning.

South Carolina’s 529 plan can be a smart vehicle for college savings, but it should be viewed as part of a broader conversation.

As for retirement, the pre-retirement mistakes we see most often come down to poor tax planning, withdrawal timing, or neglecting healthcare costs. A holistic advisor helps you see the whole chessboard. Even failing to ask what you're retiring to (rather than from) can greatly effect your future.

Ready to Evaluate With Intention?

Before you reach out to a prospective advisor, it helps to reflect on your own readiness and goals. Which areas of your financial life feel uncertain? Are you seeking more structure, greater peace of mind, or a clearer long-term path? These kinds of questions often signal it’s time for professional guidance.

At Flip Flops and Pearls, we bring together financial clarity, local insight, and a deep commitment to relationships that last. We don’t believe in cookie-cutter plans or pressure tactics. We do believe in thoughtful, strategic guidance tailored to your life.

We’ll review your current plan, surface blind spots, and show exactly how we can help—so you can make an informed decision, not a pressured one.

Sources and Additional Resources:

What Is a CFP® Professional? – Certified Financial Planner Board of Standards

Search SEC Registered Investment Advisors – U.S. Securities and Exchange Commission

NAPFA Fee-Only Financial Advisor Directory – National Association of Personal Financial Advisors