A Simple Way to Think about Model Portfolios

What is a model portfolio? Learn how this investment strategy brings structure and consistency to your financial plan.

3

Minutes

Reggie Fairchild

What is a Model Portfolio?

A model portfolio is like a recipe: 70% apples, 30% mangoes. That’s essentially a portfolio model—simple instructions for mixing ingredients.

In investing, a model portfolio is just like that recipe: a pre-built mix of assets. A thoughtful investment model portfolio balances risk, return, and your personal goals.

It’s Not Magic

Advisers sometimes talk about model portfolios as if they are magical formulas that only they know about. That’s not true. Anyone can create one. Pick any two stocks—say Apple (AAPL) 70% and Microsoft (MSFT) 30%. That’s a model portfolio. It’s probably not a good one, but it is a model.

The model tells you with really straightforward rules what to own and in what percentages. Building or using a good model portfolio can really help your portfolio's performance over the long term, through good times and bad.

We like models based on academic research of what’s worked well in the past and what’s likely to work well in the future.

Model Portfolios Explained

At its core, what is a model portfolio? It’s a curated selection of investments—stocks, bonds, ETFs, or other vehicles—grouped by asset class and weightings. Think of it as an asset allocation roadmap for you to follow.

A strong diversified portfolio spreads risk across different sectors and markets. Model portfolios can be as simple as a pre-built portfolio from a robo-advisor or a customized blend you design with your advisor.

When you add money to the account or the relative value of your investments shifts, the model tells you how to get back on track—and back to your plan.

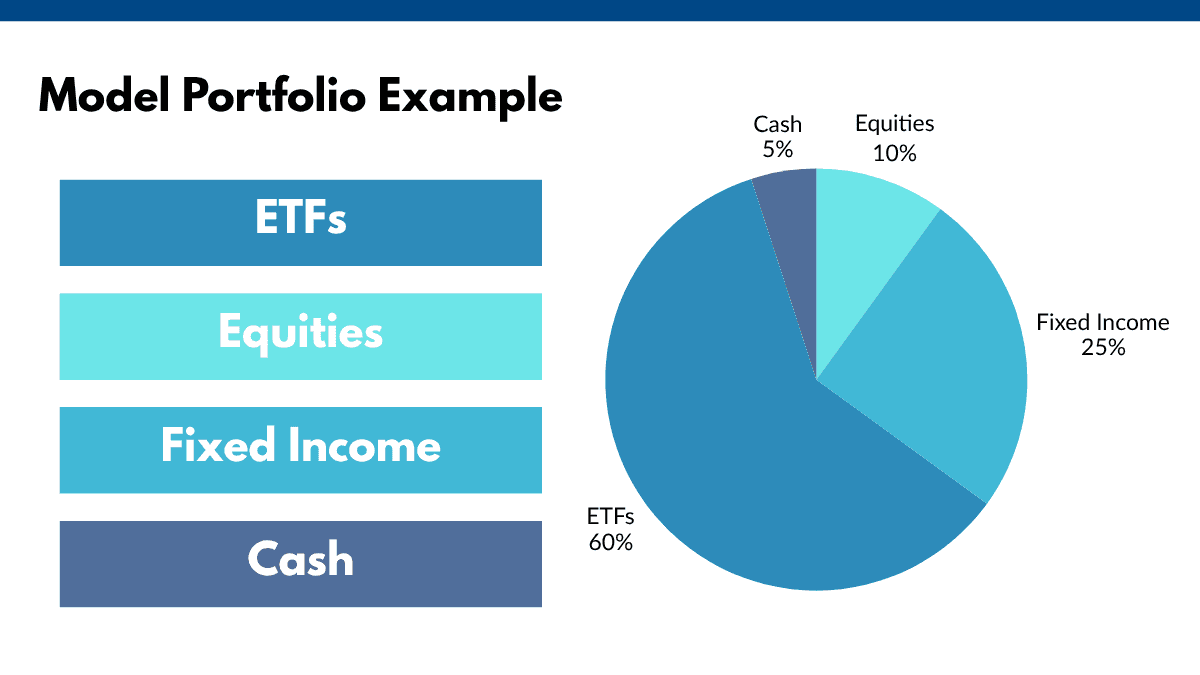

This chart illustrates a model portfolio with 60% ETFs, 10% equities, 25% fixed income, and 5% cash—highlighting how model portfolios balance growth and stability across asset classes.

Why Should I Use a Model Portfolio?

Clarity and Consistency

Following a tested strategy means sticking to your plan. You avoid emotional decisions—like chasing hot stocks or panic-selling during market dips. Declines are part of long-term growth, and a solid model helps you stay the course.

Benchmarking and Performance

Model portfolios often include benchmarks, so you can track your performance and risk levels transparently.

Characteristics of Great Model Portfolios

Clear Objective: Tailored to goals like retirement or wealth growth.

Diversification: Broad exposure across sectors and asset classes.

Cost Efficiency: Uses low-fee index funds or ETFs.

Rebalancing Rules: Clear thresholds or schedules for rebalancing.

Tax Efficiency: Techniques like tax-loss harvesting.

Understanding Risk in Model Portfolios

Volatility: How much the value fluctuates.

Drawdown Potential: Expected loss in a downturn.

Liquidity Needs: Can you access funds when needed?

Choosing the Right Model for You

Time Horizon

Short (1–5 years): Emphasis on fixed income.

Medium (5–10 years): Blend of equities and bonds.

Long (10+ years): Mostly equities for growth.

Liquidity Needs

Quick-access needs = cash and short-term bonds.

Retirement-focused = more equity tolerance.

Risk Tolerance

Ensure the model’s risk profile matches your personal comfort with volatility and your financial goals.

Key Takeaways

Model portfolios are investment recipes with clear asset mix instructions.

They simplify decisions, enhance consistency, and save time.

Best models emphasize diversification, low cost, and tax-efficiency.

Tailor your portfolio to time frame, liquidity needs, and risk profile.

With the right model, you move from guessing to guided investing—transforming structure into strategy.

Sources and Additional Resources:

What Are Model Portfolios? – Dimensional

Model Portfolio Education – State Street

Model Portfolio Definition – Morningstar

Why Use Model Portfolios? – Russell Investments